The purpose of this post is comparing the best mid tier credit cards. Allows flexibility to choose the gift of your choice when you redeem your.

The Best Credit Cards Of 2020 Valuepenguin

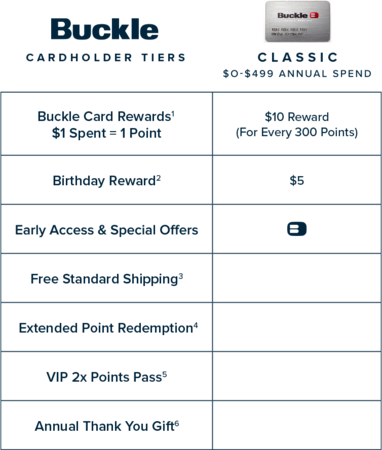

Credit card tier list. Substantially improving your credit is a task months or years. This is the best mid tier credit card according to tpg readers sarah silbert. Both the american express gold card and the american express business gold card straddle the line between a mid tier and an ultra premium card. This bonus offer is unlimited which can be good news if youre planning on. For me tier 3 and tier 4 cards are cards that you get once youve maxed out on the first. Each credit card has its own unique offering.

For example the chase sapphire reserve earns 3x on travel comes with unlimited priority pass access 100 global entrytsa precheck credit and a 300 travel credit to offset the annual fee. Increased earning structures relative to modest annual fees provide a nice balance thats attractive to many travelers. Current southwest credit card members can earn 3000 tier qualifying points tqps per 10000 in card purchases. Tier three credit scores range from 660 to 699. Mid tier credit cards are great for travelers who want a little bit more from their credit card but dont want to pay a 500 annual fee. Tier one travel cards also have higher spending multipliers compared to the cards in tier two.

They can be categorised into 3 main types. Each of the cards on this list has its advantages and disadvantages. Which mid tier hotel card is best for you. Terms apply to the offers listed on this page. This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products.

For each type of credit card ive placed cards into four tiers. Want more credit card news and travel advice. Add in the 4th award night perk and the global entrytsa precheck application fee benefit and youve got an all star lineup of perks for a mid tier hotel credit card. Having a credit score fall in the range of 660 to 699 means is indicative of good credit. Rewards you with miles for every dollar spent. Top tier credit cards generally require credit scores in the good to excellent range measured by the fico scoring model as 670 850.

Tier three fico scores will generally have no problem qualifying for loans or credit cards although they will not receive the best interest rate. Rewards you with cash credited into your card to offset future spending. Tier 1 cards are cards that i think should be a part of every serious points enthusiasts portfolio and tier 2 cards are cards to start focusing on after you have most of the tier 1s.